Renewable energy certificates or other environmental attributes of the electricity generated either upfront or over time the payment likely will be considered taxable income8 If that is the case the payment will increase your gross income but it will not reduce the federal solar tax credit. For example if you pay 14000 for a solar panel.

Energy Storage Tax Credits Explained Energysage

All other solar energy systems such as photovoltaic systems must meet the new total output.

Solar renewable energy credits taxable income. The solar panel system qualifies as a five-year property and also qualifies for the 50 bonus depreciation under Sec. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system. Many people who sell electricity from their solar panels receive a 1099 from the power company.

Renewable Energy Technologies Income Tax Credit Page 8 of 15 output capacity of at least 5 kilowatts one system has been installed and placed into service for the purpose of calculating the credit. Assuming the tax rate is 34 A will receive a tax savings of 112200 on the depreciation. It is a well developed concept of tax law that an item of gross income is taxable unless specifically excludable from income.

GST and the Small-scale Renewable Energy Scheme. On this page you will find information and documents pertaining to the Renewable Energy Technologies Income Tax Credit RETITC provided under 235-125 Hawaii Revised Statutes. The Mass Solar Loan program which ran from 2015 to 2020 made solar financing easier for nearly 5800 Massachusetts homeowners but little more than a third of those loans went to low-income households.

Solar Rebates Feed in Tarriff Revenue. Section 25Dd2 defines the term qualified solar electric property expenditure. You are considered to have a self-employed business and you are the owner.

Investment tax credits offer no real help to households with limited taxable income. Posted Dec 22 2009. The Mass Solar Loan program which ran from 2015 to 2020 made solar financing easier for nearly 5800.

Congress extended the investment tax credit used for residential and commercial solar projects at its current rate of 26 for two years in December 2020 as part of a 23 trillion spending and. Tax Deduction Deduction of taxable income. It will drop to 22 in 2023 and expire at the end of 2023.

Are credits or payments you receive for power generated by solar panels assessable against pensions. What is the federal solar tax credit. Imposed for the taxable year in an amount equal to 30 percent of the qualified solar electric property expenditures made by the taxpayer during such year.

Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance. If you have Non-employee compensation Box 7 of a 1099-MISC according to the IRS it is considered income from self-employment. By Karin Price MuellerThe Star-Ledger.

The Consolidated Appropriations Act 2021 extended the 26 tax credit through 2022. As a result A is entitled to a depreciation expense of 330000 which is 60 of the 550000 depreciable basis. Renewable Energy Technologies Income Tax Credit RETITC HRS 235-125.

Residential solar energy investors claim this tax credit under Section 25D while commercial solar investors claim it under Section 48. These state tax credits allow the homeowner to deduct a portion of the cost of a solar system from their state tax bill. Solar Renewable Energy Credits income is not exempt from tax laws.

Many bloggers have cited Internal Revenue Code IRC section 136 Energy Conservation Subsidies Provided by Public Utilities as support for excluding SREC income from gross income. Tax Credit A direct dollar-for-dollar deduction off of your income taxes that you would normally pay to the federal government. Rebate from My State Government.

Investment tax credits offer no real help to households with limited taxable income. Examples include solar panel systems small-scale wind systems small-scale hydro systems solar water heaters and air source heat pumps. The Small-scale Renewable Energy Scheme SRES provides a financial incentive for households and businesses to install eligible small-scale renewable energy systems systems.

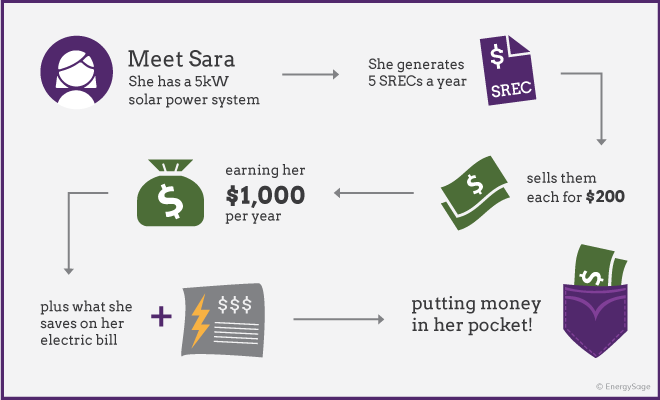

Individuals claim the residential tax credit on their. Updated Apr 01 2019. Are SRECs Taxable.

B The credit may be claimed for one solar energy system installed and placed in service per property which fails to meet the applicable total. Is a Solar Photovoltaic Rebate taxable income.

Federal Solar Tax Credit How Does It Work Sunpro Solar

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

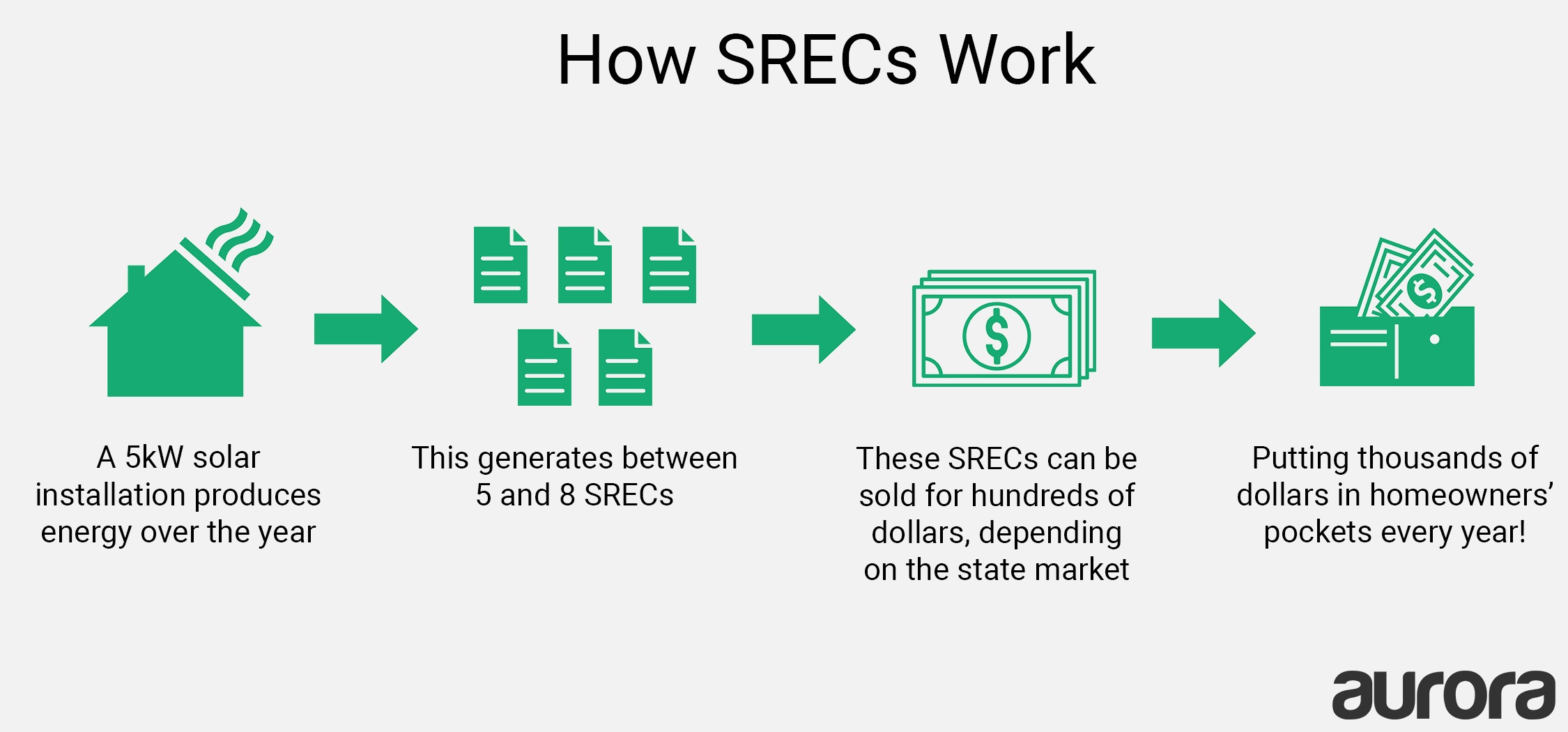

Srecs Understanding Solar Renewable Energy Credits Energysage

Financial Incentives For Installing Solar A Beginner S Guide Aurora Solar